Climate-related risk management – supervision is heating up!

A new climate for supervision on climate-related risk management

Faster than probably anyone would have expected, supervision on the prudent management of climate-related and environmental risks by the banking sector has become the top priority for the Dutch Central Bank (De Nederlandsche Bank, DNB) and the European Central Bank (ECB). Exactly two years ago, I wrote a Finnius blog on DNB’s Good Practices on ‘Integration of climate-related risk considerations into banks’ risk management’. For a more detailed explanation on climate risks for banks, I refer to that blog. Back then, I was still a bit critical on DNB’s proposed good practices. Part of my concerns dealt with the legality of DNB’s approach and the level playing field within the European Banking Union. If supervision on climate risk management should be part of banking supervision, it should occur across the European Banking Union in a harmonized manner.

However, since my 2020 blog, EU developments in this area followed each other with the speed of lighting. Already in the fall of 2020, the ECB published its own Guide to climate-related and environmental risks, outlining the ECB’s thirteen harmonized expectations on banks’ management of these risks throughout the Banking Union. I also warmed up to the idea that climate change – and the policy measures taken globally to prevent further damage – may have an enormous impact on a bank’s typical risk categories such as credit risk, market risk and operational risk. By now, there seems to be a general consensus in the Banking Union that this topic is a justified top priority of the supervisory authorities (albeit proportionally of course). Still in certain other jurisdictions, such as the United States, the topic of whether the banking supervisor should focus on climate risks is still part of a heated (political) debate.

Looking at the similar development of previous other supervisory hot topics (such as integrity/anti-money laundering), I predict that managing climate risks will soon be the next big supervisory enforcement theme. So now it is high time for an update blog on the supervisors’ approach to this topic.

Climate-related risk in the Banking Union

Already one year after it published its regulatory expectations, the ECB concluded that banks should better manage their climate-related risks. In a November 2021 Report on the state of climate and environmental risk management in the banking sector, the ECB analyzes how European banks are adapting their practices to manage climate and environmental risks in line with the ECB’s expectation. After having studied all European significant banks under its direct supervision, the ECB concludes that banks have taken some first steps to incorporate climate-related risks, but no bank comes even close to meeting the ECB’s expectations. Banks have made efforts to meet these expectations in terms of governance, risk appetite and operational risk management. However, according to the ECB they are lagging behind in areas such as internal reporting, market and liquidity risk management, and stress testing.

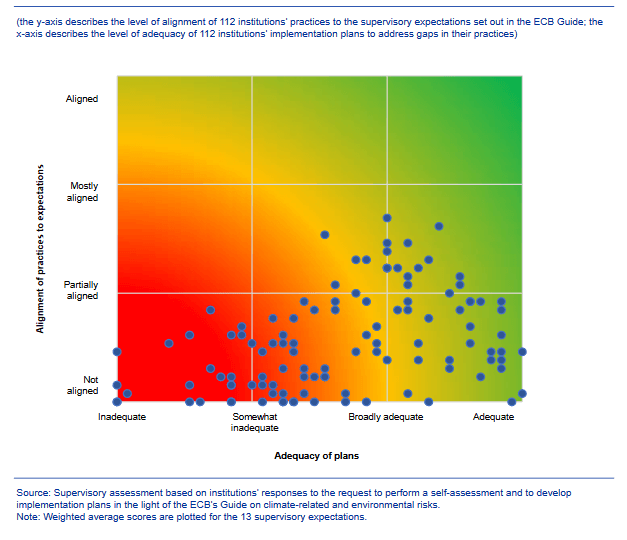

Concluding, the ECB found the quality of the plans too low, and progress to actually implement the expectation into a bank’s practice too slow. Especially, the current alignment of the banks’ practices with the ECB expectation was substandard. See the interesting ECB diagram below.

The ECB has sent individual feedback letters to banks asking them to address their shortcomings. Going forward, banks are expected to for example take climate risks into account in their Internal Capital Adequacy Assessment Process. In some cases, banks have even received an additional capital requirement as part of Supervisory Review and Evaluation Process (SREP).

As a next step, the ECB will conduct a full fletched thematic assessment of how individual significant banks are prepared to manage climate and environmental risks, with a deep dive into their integration into strategy, governance and risk management. This full review will take place in the first half of 2022. The findings of this review will be taken into account in individual banks’ SREPs, and may lead to additional measures or Pillar 2 capital requirements.

At the same time, from March through July 2022, the ECB will perform its 2022 ECB Climate Risk Stress Test (CST) at significant banks.

In short, the stress test consists of three different modules:

- A comprehensive questionnaire to assess how banks build their climate stress test from a risk

management perspective. - A peer benchmark analysis to compare banks based on a common set of climate risk statistics. These statistics reveal how much banks rely on revenue from carbon-intensive industries and the share of greenhouse gas emissions that banks finance.

- A bottom-up stress test focused on transition and physical risks. The stress test assesses how extreme weather events will affect banks over the next year, how vulnerable banks are to a sharp increase in the price of carbon emissions over the next three years, and how banks respond to transition scenarios over the next 30 years.

DNB’s approach

DNB, being the regulatory front runner on the topic of climate-related risk supervision, is also closely watching whether less significant banks are meeting the DNB good practices and ECB expectations. In the summer of 2021 it asked the banks to complete a questionnaire on this topic. By January 2022, DNB provided the individual banks with written feedback on their input. It goes without saying that, generally, DNB saw a lot of room for improvement. It has given the banks until June 2022 to show DNB that they have taken into account DNB’s comments.

In December 2021, DNB published a Report providing an overview of the integration of climate and sustainability risks into the core processes Dutch financial institutions, including banks. In short, DNB concluded that financial institutions are aware of sustainability risks but do not sufficiently manage them. Sustainability risks are often not included in the risk management cycle, and especially not in a quantitative manner.

DNB does not only require banks to manage their climate-related risks. DNB’s report also included other financial institution types that it supervises, such as insurers and pension funds. For insurers, DNB published the Good Practice on Integrating Climate Related Risks in the ORSA already at the end of 2019. By the end of 2021, DNB also published Good Practices on this topic for investment firms and fund managers.

To promote the topic of climate-related risk management into the board rooms of banks, insurers and pension funds, DNB will integrate this topic in its fit and proper tests for management and supervisory board members.

To be complete: in this blog I am discussing prudential supervision by DNB and the ECB mostly. However, the Dutch Financial Markets Authority (Autoriteit Financiële Markten) will also strictly supervise financial institutions on sustainability topics, but then specifically in relation to disclosure (such as compliance with the EU Sustainable Finance Disclosure Regulation).

Be prepared!

The supervisory policy process that we are now seeing with the climate-related risk topic reminds us of DNB’s supervision in other recent supervisory enforcement themes such as AML/integrity supervision. First, there is a phase of DNB policy research and ‘soft’ guidance. Then, the supervisor performs a sector wide assessment followed-up by thematic investigations. The findings are then used by DNB to informally push institutions towards an enhanced set-up of their internal organization. And finally, a next round of individual reviews may result in formal enforcement measures, including directives. Ultimately this may lead to punitive fines, and suitability reassessments for the management.

Both the ECB and DNB have indicated that supervision on climate risks is one of their 2022-24 supervisory top priorities. This year the ECB and DNB will still use to nudge institution to a higher level of compliance, and to benchmark the various peer institutions with each other. It is important to note that the supervisors will not only require the paperwork (internal risk management and governance processes) to be compliant with their expectations. Institutions must also in reality practice what they preach, and be able to show evidence of those practices.

But then come 2023-24, after the first pressuring phase has ended, we expect the competent authorities to actually show their teeth and impose enforcement measures on the institutions that still do not meet the supervisors high standards. This may include the supervisors imposing directives, higher Pillar 2 capital, fines and reassessments of board members.

Supervision on management of climate-related and environmental risk will be the next big regulatory thing. It is time to further implement the supervisors’ expectations applicable to your institution into your internal organization and practice. As with climate change itself, the supervisors will not wait.